In the case of a company keeping pursuant to its articles a branch register in any place outside Malaysia the lodgement of annual return must be made. Kindly refer guide notes explanatory notes which can be accessed from IRBM official portal before filling up.

The tax return is deemed to be a notice of assessment and is.

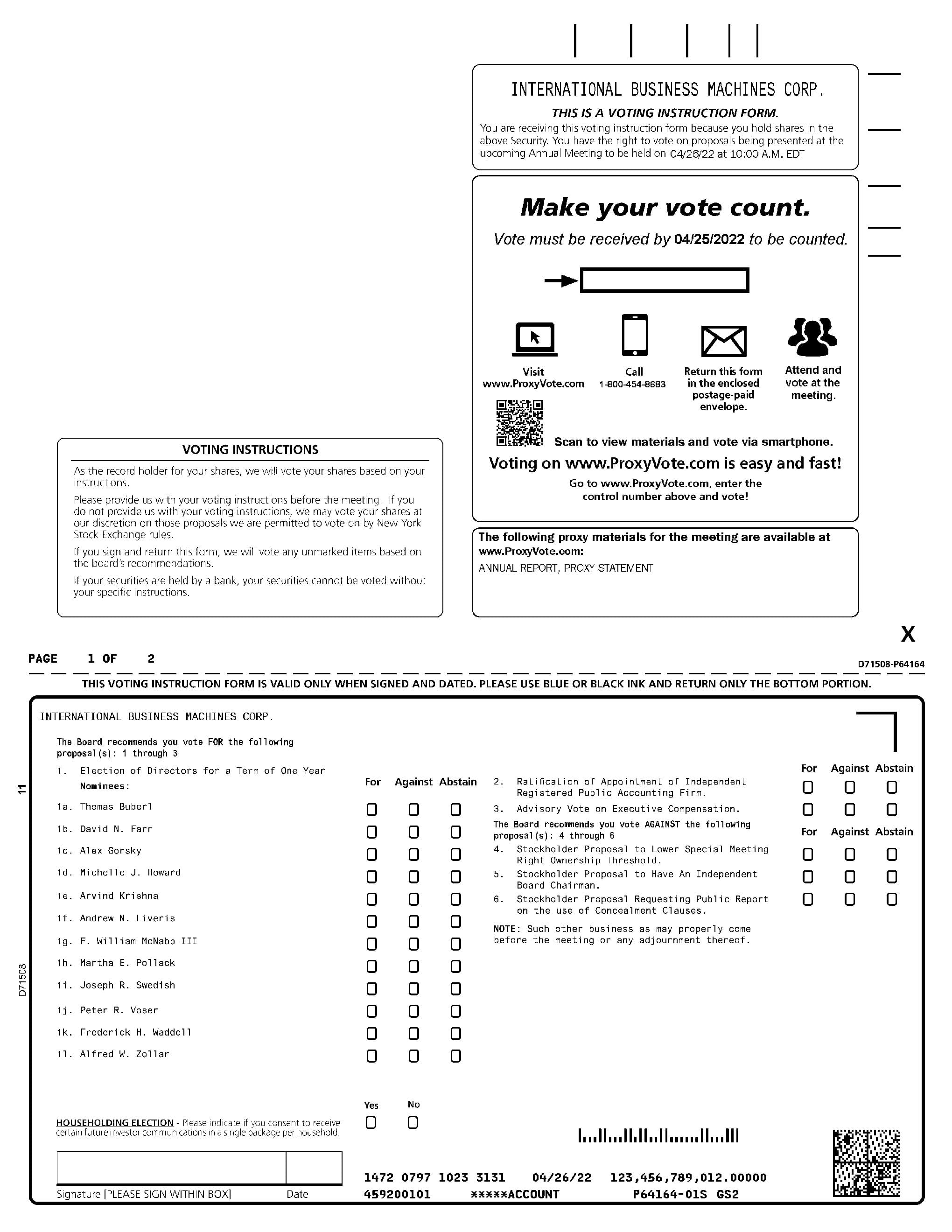

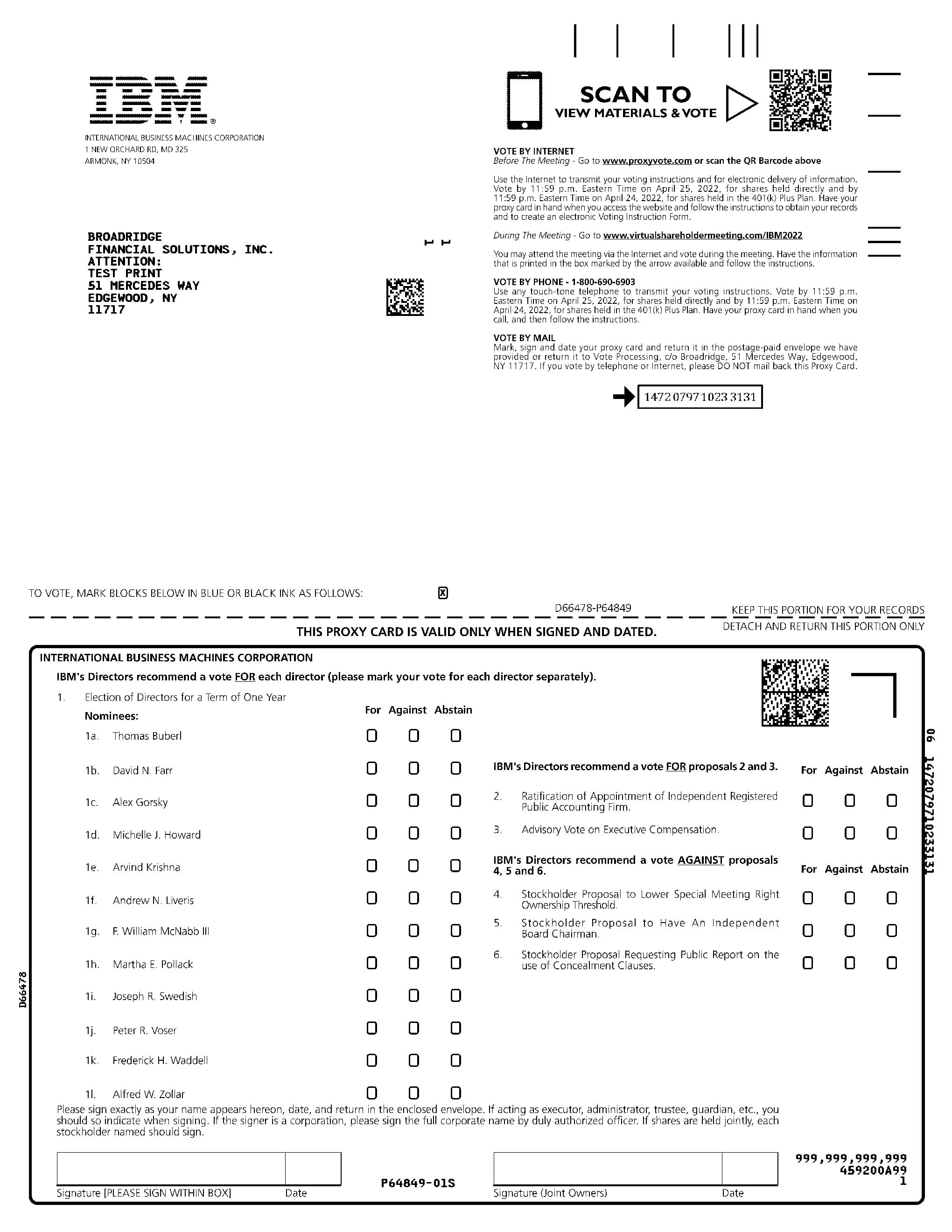

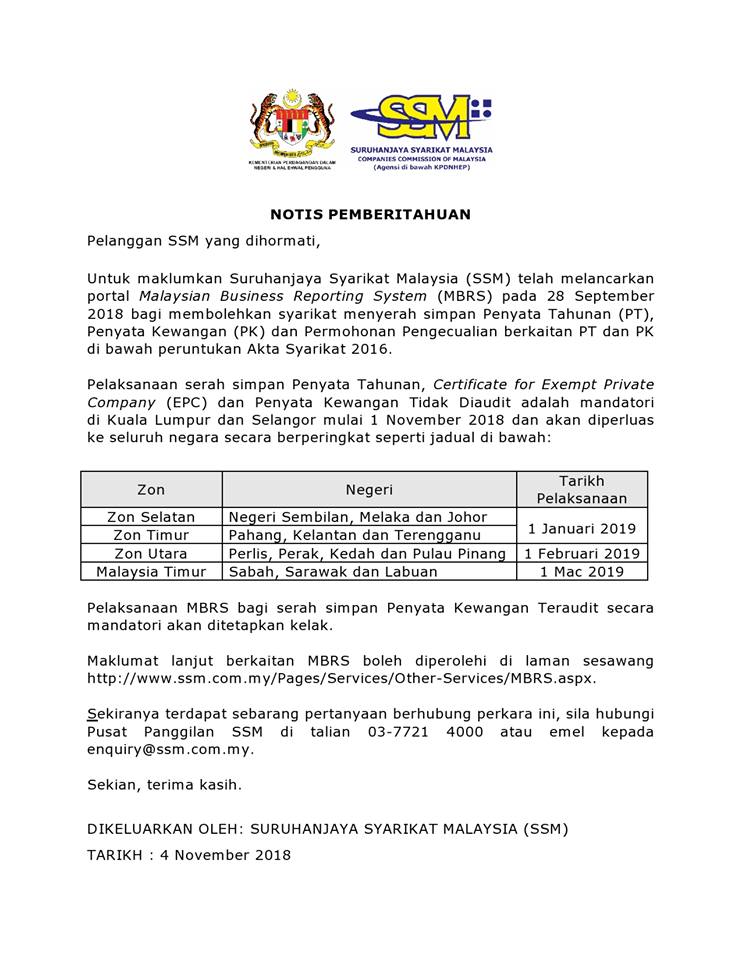

. The Annual Return is an important document that must be sent to SSM as prescribed. Go back to the previous page and click on Next. Duty To Lodge Annual Return Financial Statements With SSM.

Such lodgement can be done via the MBRS Portal or over the. Made up to the 19th day of November 2011 being the. Submission of the annual return to the Institute is MANDATORY as stated in By-law 5009 1d and 2 of the Institutes By-laws On Professional Ethics Conduct and Practice.

Annual Accounts are financial accounts profit loss etc. Company Annual Return In Malaysia. Manually to Tax Information Record Management Division LHDNM.

The annual return signed by a director or by the manager or secretary of the company shall be lodged with the suruhanjaya syarikat malaysiassm within one. Annual return of a company having a share capital. All local companies Section 68 and foreign companies Section 576 registered within SSM must lodge Annual Return AR.

Annual Returns for companies with an Anniversary Date in 2017 only need to be made in. Subsidiary company has or has not established a place of business in malaysia there shall be. 5 A company not having a share capital shall within one month after each annual general meeting of the company lodge with the Registrar a return in the prescribed form containing the particulars referred to in subsection 6 and made up to the date of the annual general meeting or a date.

An annual return is a snapshot of general information about a companys directors secretary where one has been appointed registered office address shareholders and share capital. FormLEMBAGA HASIL DALAM NEGERI MALAYSIA REMUNERATION FOR THE YEAR E RETURN FORM OF EMPLOYER N 831 OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 Date received 1 2 FOR OFFICE USE E. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020.

Click on e-Filing PIN Number Application on the left and then click on Form CP55D. Companies with an Annual Return dated 31 December 2019 andor Financial Statements for the financial year ending 30 June 2019 are required to lodge such Annual Return andor Financial Statements by or before 6 February 2020. An individual who earns an annual income exceeding RM41000from Malaysia must register a tax file and file annual tax returns.

In the case of a company keeping pursuant to its. Taxable income includes all your income derived from Malaysia eg. Click on Permohonan or Application depending on your chosen language.

Companies must submit to the SSM an Annual Return AR for each calendar year. Rental from property in Malaysia and is not confined to your salary from employment. The annual return signed by a director or by the manager or secretary of the company shall be lodged with the Suruhanjaya Syarikat Malaysia SSM within one month after holding its AGM or in the case of a company keeping pursuant to its articles a branch register in any place outside Malaysia within two months after the annual general meeting.

IRBM official portal hasilgovmy Forms Download Forms Individual Year of Assessment. The Annual Return is an important document that must be sent to SSM as prescribed. This includes Exempt Private Companies.

The annual return signed by a director or by the manager or secretary of the company shall be lodged with the Suruhanjaya Syarikat Malaysia SSM within one month from the date its AGM held. Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company. 5 The annual return shall be signed by a director or secretary of the.

When to File the Annual Return. The annual return is an electronic form lodged with ACRA and contains important particulars of the company such as the name of the directors secretary its members and the date to which the financial statements of the company are made up to. Annual return by company not having a share capital.

FORM OF ANNUAL RETURN OF A COMPANY HAVING A SHARE CAPITAL Annual return of the HAPPY FAMILY SDN. Share this on WhatsAppSubmission of Annual Return of a company in Malaysia are the most important legal requirement set by Companies Commission Malaysia SSM By AZIZAM AZIZAN The annual return is a document that describes a companys policies. All member firms are required to update their records with the Institute by submitting an annual return on the particulars of their firm and branches where applicable on a yearly basis.

RETURN FORM OF EMPLOYER. Return Forms can be submitted by two 2 methods. According to Section 165 4 companies are required to file their annual return and related forms within one month after its Annual General Meeting AGM.

As stated in the Companies Act 2016 the Annual Return of a company must be submitted on each anniversary of the date of the company and not more than 30 days from that date. The subsidiary company has or has not established a place of business in Malaysia there shall be annexed to the balance-sheet and profit and loss account of the holding company a. The Registrar shall have the power to determine the form and manner in which the annual return is to be lodged.

Download a copy of the form and fill in your details. The annual return signed by a director or by the manager or secretary of the company shall be lodged with Companies Commission of Malaysia SSM within one month from the date its AGM held. Malaysia Companies Act 2106 Company Auditor Clauses.

It is due within 30 days from the anniversary of its registration incorporation date in Malaysia. Malaysia Companies Act 2106 Company Accounting Clauses. The annual return provides critical information that helps the companys stakeholders to make.

In simple words your Annual Returns will be due after 18 months of your company registration in Malaysia. A director or secretary can file the annual return on the VCC Registration and Filing Portal. The deadline for filing your income tax returns form in Malaysia varies according to what type of form you are filing.

The annual return is an electronic form lodged with ACRA that contains important particulars of the VCC such as the name of the directors secretary and information relating to any sub-fund if applicable. In the Companies Act 1965 new companies in Malaysia are required to hold their first AGM within 18 months from their incorporation while subsequent AGMs need. Registration of a tax file can be done at the nearest Inland.

The appointed officer eg. Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. Form of annual return of a company having.

3 Via e Note - 2021 CP8-Pin. The Annual Return is not to be confused with Annual Accounts.

.png)

Leave Management Leave Application Form Templates

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

Free 9 Sample Employee Update Forms In Ms Word Pdf

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Sample Letter Of Intent Letter Of Intent Letter Example Letter Sample

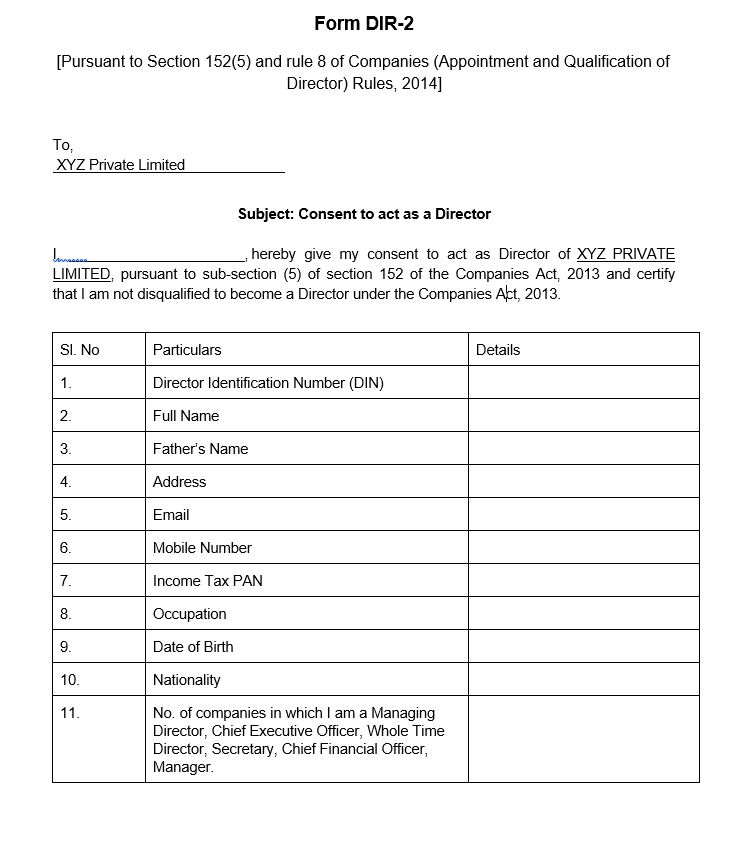

Form Dir 2 Director Consent For Company Learn By Quickolearn By Quicko

Editable Annual General Meeting Agenda Template 8 Free Templates In Annual Board Meeting Age Meeting Agenda Agenda Template Meeting Agenda Template

Pin On الهم صل علي سيدنا محمد الفاتح الخاتم الناصر الهادي

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Xiaomi Mi 11 Video Promotion At The Night Safari Singapore Promotional Video Singapore Night

Form 24 Return Of Allotment Of Shares Company Registration In Malaysia

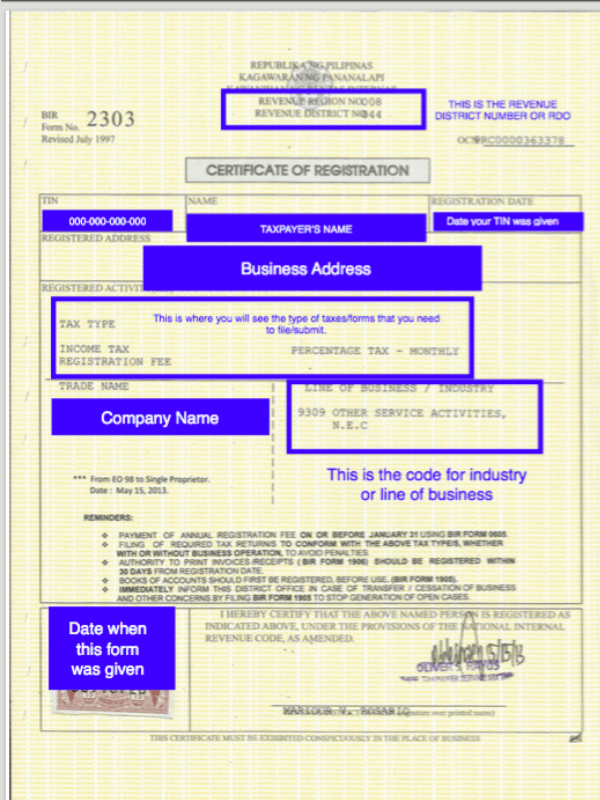

2021 How To Get Your Bir Certificate Registration Or Form 2303

7 Tips To File Malaysian Income Tax For Beginners

Form 9 S17 Know The Statutory Forms Of Your Sdn Bhd Foundingbird